ARE IPHONES REALLY CHEAPER IN USA AND DUBAI ?

- dhruvtalksstech

- Sep 3, 2022

- 4 min read

Updated: Dec 5, 2022

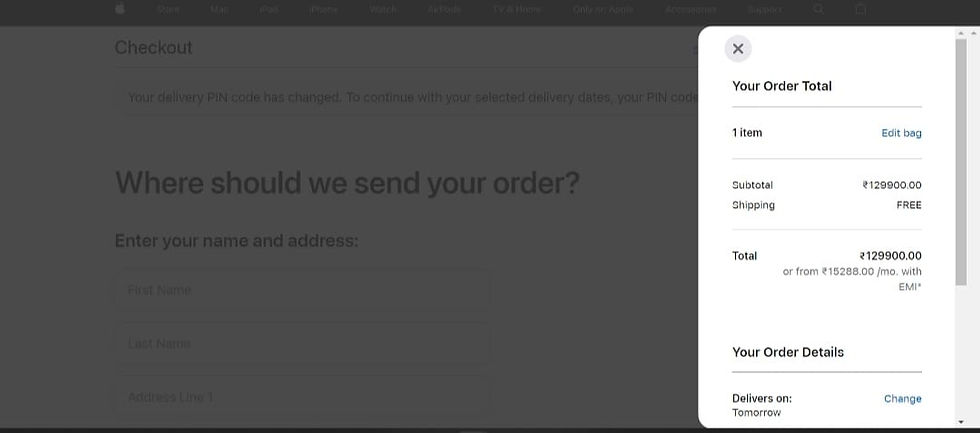

This blog would make a lot of sense to you if you are from the Indian subcontinent region. iPhone prices are the highest in this part of the world. iPhone 13 Pro, for instance, costs 120,000 Rs (about 1500$)(1$= 80 INR approx) which makes it 50% costlier than the same iPhone which is sold in the States (1000$). iPhones are similarly priced in Dubai as in the States. Prices vary across Dubai as Apple does not have any official stores in Dubai. It only sells its phones to third-party sellers who change prices daily based on local demand. But it largely remains 50-100 $ more expensive than their US counterparts (I AED= 21.5 INR approx). I could find the base 13 Pro for 3900-4000 AED. It's a common request in India to ask relatives and friends to buy iPhones from the US and Dubai and then bring them to India for personal use because they seem so much cheaper on paper. Even the base 13 model sells for 80000 Rs (1000$) as opposed to 800$ in the US.

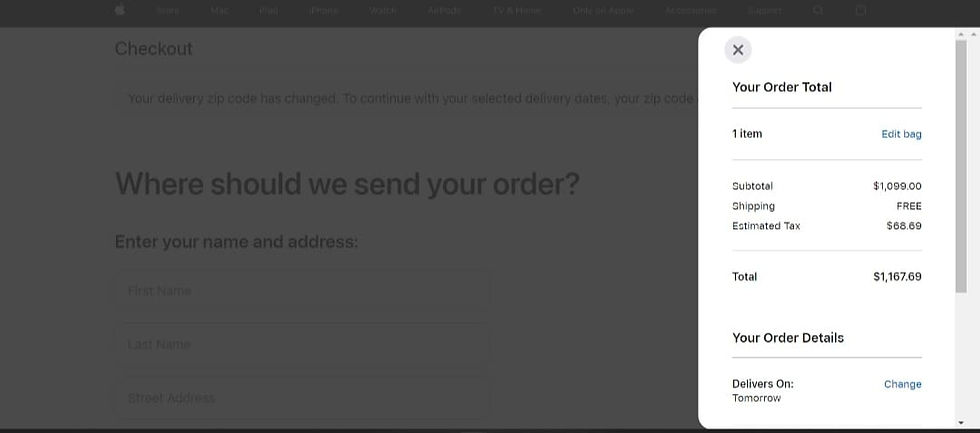

But the very concept of 1000$ starting price in the US is very misleading. See, unlike India, where GST (18% on smartphones) reigns and there is the same percentage of tax levied on all items across all the states, in the US, tax varies from state to state and is generally 6-8% from what I can tell. So, the prices that you see Apple reveal on stage are exclusive of taxes. Taxes are added later as part of the purchase. My father bought a 12 Pro last year from Boston, Massachusetts and he got it for 1063$(85,000Rs), not 1000$. So, if you are planning to buy an iPhone from the US, check the sales tax for that state specifically and then add that to get the final price of the product. The same applies to all other electronic devices of all brands. Not just iPhones. The addition of tax in itself reduces the gap from 40,000 Rs to 35,000 Rs (considering the Pro models)

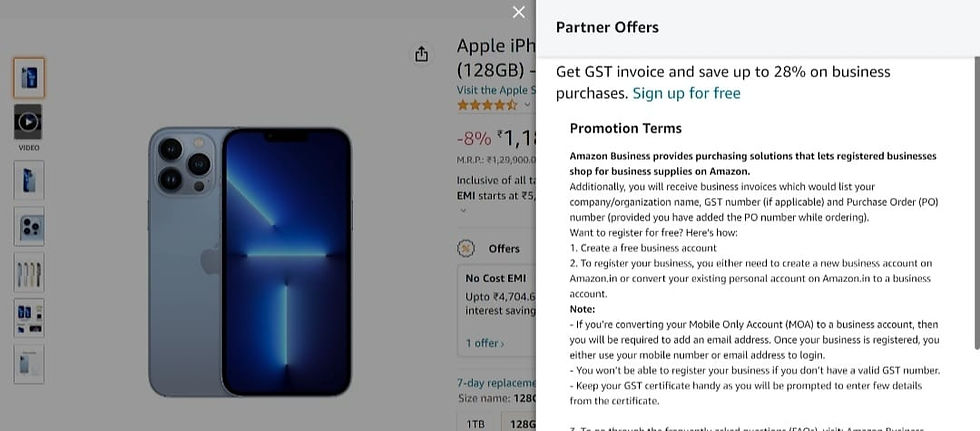

You may know about this one if you are a business owner. In India, if you buy a smartphone in the name of your business, then you can claim the 18% GST tax levied on that phone by showing the phone as part of your business purchases. This drastically reduces the cost of the phone. The base Pro Model would cost 98,400 Rs (rounded to 100,000 Rs) from the initial 120,000 Rs. This is a substantial reduction and makes the iPhone a lot more reachable. Then, you should take into account that you would be getting some cashback by using certain bank debit and credit cards since you are a business. Kotak and HDFC Bank generally offer a lot of such benefits. The 100,000 Rs price tag will then come down to 94000 Rs generally. I won't take into account trade-ins and all because I don't believe in trade-ins or selling old phones.

You've also got to remember that if 1$=80 INR, the bank would charge you 1 INR more on average on the exchange rate as a convenience fee. This is standard practice and one that you will have to bear as you cannot use INR in the US. So, whatever the final price of the iPhone in the US after levying state-specific taxes, multiply the USD by (exchange rate at the time + 1) to get the amount in INR. This is what you will truly have to pay for the iPhone and then you can compare if it's that much cheaper. It is also noteworthy that carrying thousands of dollars to buy Apple products is not very easy as there is a limit to how much tourists can carry. You may need to show a receipt for the cash in USD and declare in advance if you would be carrying big amounts. This is done to keep dark money out of circulation as someone with unaccounted-for money may try to convert it into USD from banks and then spend all of it in the US. This would hurt tax regimes and is illegal. Beware of this practice.

Using this methodology, I am going to list the prices of iPhones in Boston and iPhones in India. You would see for yourself that yes, iPhones are still cheaper in the US but not as dramatically cheaper as people make them out to be.

The exchange rate being considered: I USD = 80 INR

City in the US: Boston

Tax in Boston on smartphones: 6.25%

(In USA):

iPhone 13 Mini = 745$ (60,000 INR)

iPhone 13 = 850$ (69,000 INR)

iPhone 13 Pro = 1063$ (86,000 INR)

iPhone 13 Pro Max =1170$ (95,000 INR)

(In India):

iPhone 13 Mini = 51,500 INR (640$)

iPhone 13 = 60,500 INR (745$)

iPhone 13 Pro = 92,500 INR (1155 $)

iPhone 13 Pro Max = 100,500 INR (1260$)

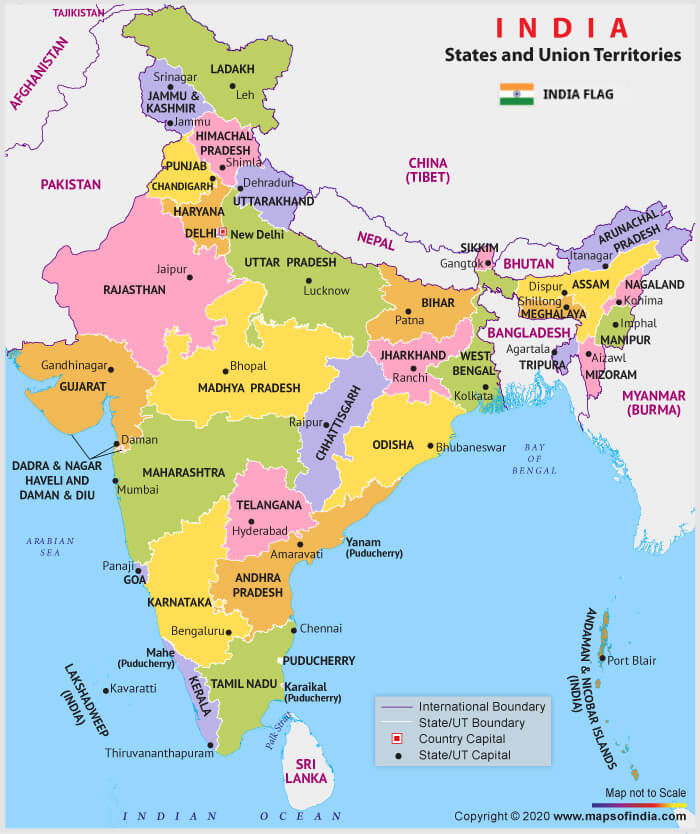

These calculations may vary a bit in future by a few dollars because the exchange rate fluctuates every day and I can't predict it at the time of writing the blog. That's why I have taken a baseline value. You can see that buying the non-pro models from the US makes absolutely no sense and are cheaper in India. You can consider buying the Pro models from the US but they are only 90$ cheaper. I hope I was able to clarify my points and bust the myth that iPhones are so much cheaper in the US. The price of Pro models may reduce further in the future as manufacturing production begins in the Chennai Foxconn assembly plant.

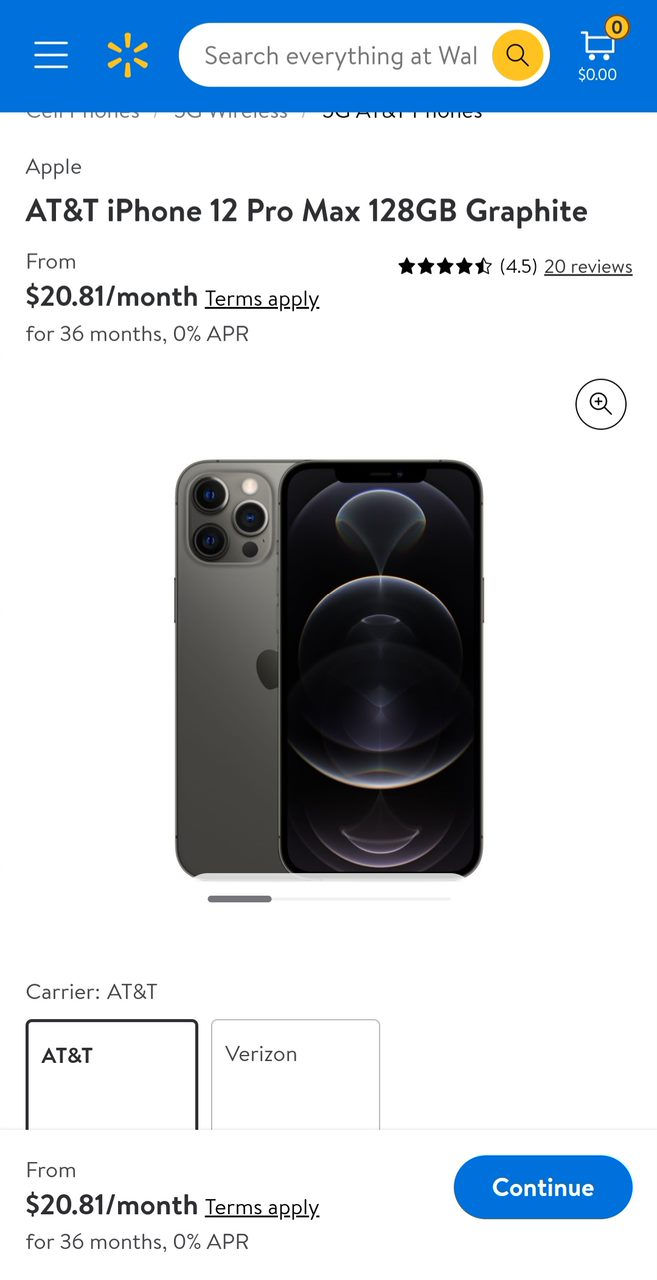

It makes more sense to buy last year's Pro models from Walmart for about 700$ (Pro) and 800$ ( Pro Max) [Price inclusive of 6.025% tax in Boston]. Last year's Pro model is generally available for 1000$ (inclusive of an 18% reduction and 6000 INR cashback). The difference is very considerable here as 300$ is a lot of money and enough to buy another Android phone actually.

SUBSCRIBE TO MY FORMS AND YOU WILL BE THE FIRST TO KNOW WHEN A BLOG GOES UP AND LIVE

If you made it this far, a sub to my updates would be ………. THOUGHTFUL !!!!!

JAI HIND

The Apple Park

Comments